- Introduction:

- Any money received by a business is considered a receipt.

- Before recording a receipt, ensure at least one cash or bank account is established.

- Accessing the Receipts Tab:

- Navigate to the Receipts tab in ElevateBooks.

- Click on “New Receipt” to start recording a new transaction.

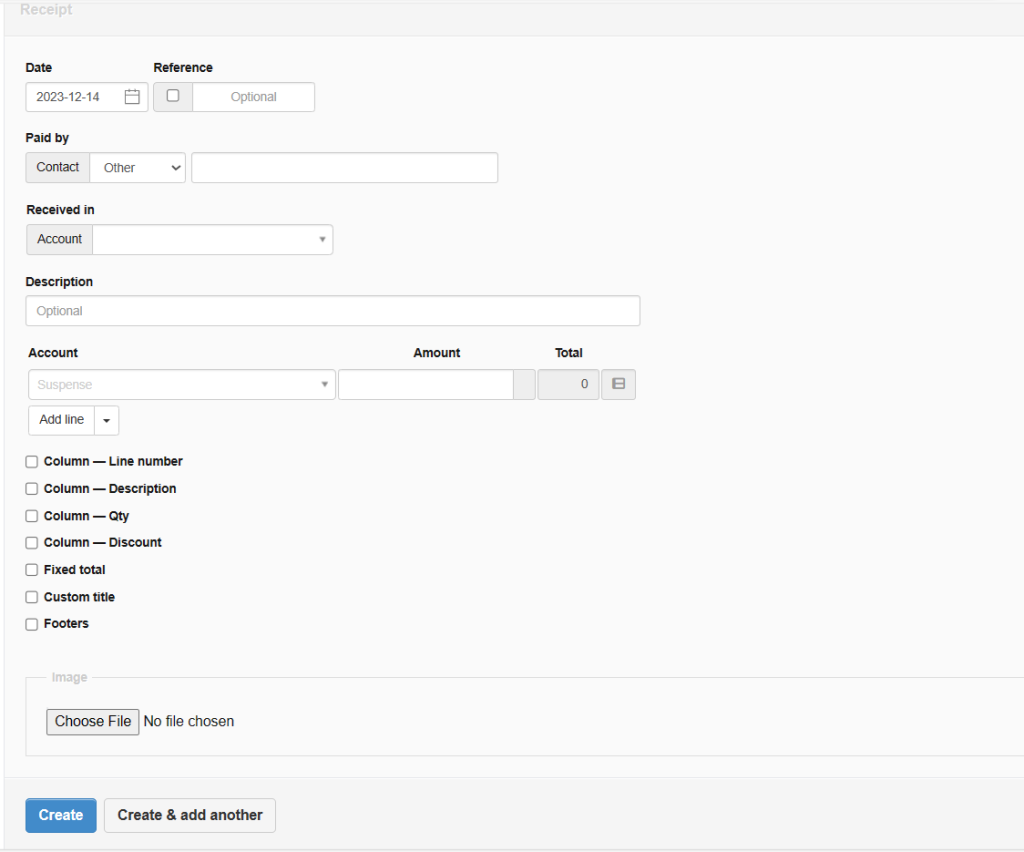

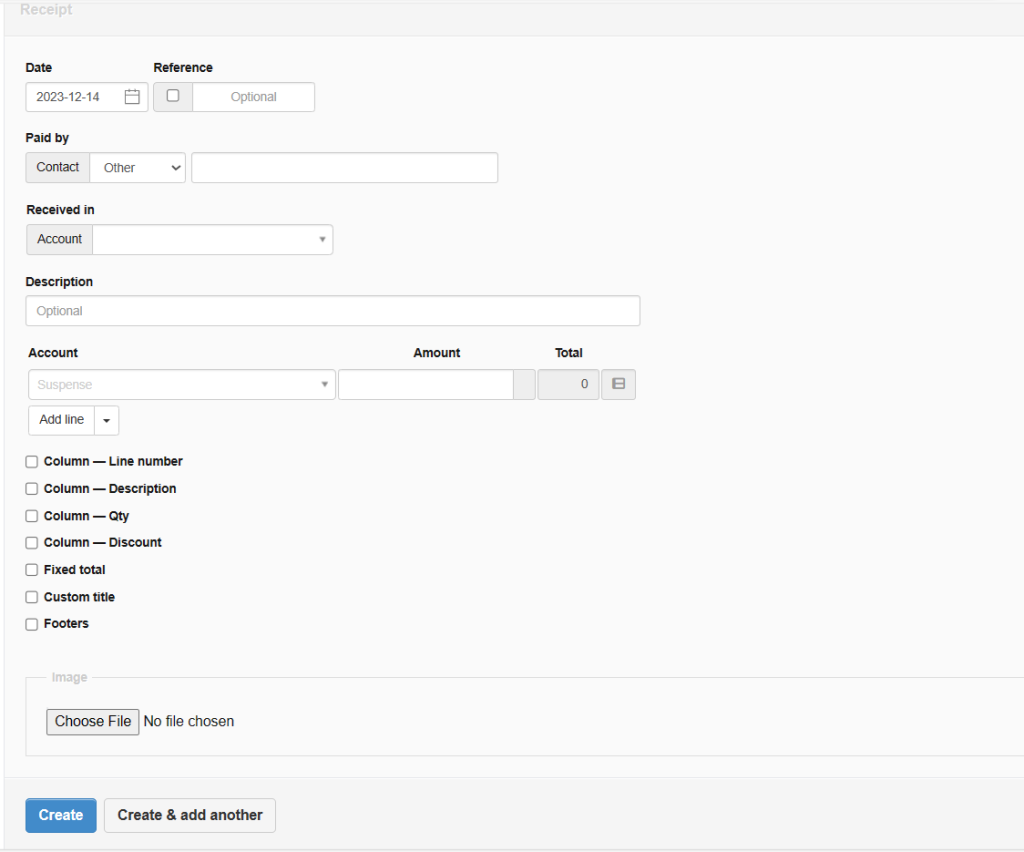

- Filling in Basic Information:

- The date is automatically set to today but can be edited.

- Reference (optional): Can be used for cheque numbers, bank confirmation numbers, or other internal sequences.

- “Paid by”: Identify the person or entity from whom money is received. Choose between “Other,” “Customer,” or “Supplier.”

- Selecting the Receiving Account:

- Choose the bank or cash account where the money is being received.

- If a bank account is selected, specify the clearance date.

- Additional Details:

- Description: Provide an optional summary of the transaction.

- Item Field: For predefined inventory or non-inventory items.

- Account: Select the account to post the receipt.

- Description on Line Items: Add specific information if needed.

- Quantity and Pricing:

- Qty: Enter the quantity of goods or services (defaults to 1 if left blank).

- Unit Price: Lists the price of a single unit or the entire amount for the line item.

- Tax Codes and Other Fields:

- Tax Code: Select if applicable.

- Division and Project: If defined and applicable.

- Inventory Location: If inventory locations are defined and applicable.

- Tax Calculation:

- Check or uncheck “Amounts are tax exclusive” based on whether taxes are included in unit prices.

- Discounts and Themes:

- Apply Percentage or Exact amount discounts if needed.

- Choose a Custom theme or enter a Custom title if desired.

- Display Preferences:

- Control the display of tax amounts for individual line items.

- Saving the Receipt:

- Click “Create” to save the receipt.